Reporting or earnings season is the time of year when most publicly listed companies release their annual financial results and announce the dividends they intend to pay.

It can often be a volatile time for share prices, depending on whether companies impress or disappoint.

The recently completed August 2025 ASX reporting season highlighted the resilience of small cap stocks, with many companies delivering solid earnings despite a challenging environment.

Share price swings were significant, with nearly half of stocks moving more than 5% on results day. Encouragingly, positive surprises outweighed disappointments – especially among companies tied to the Australian and New Zealand domestic economies.

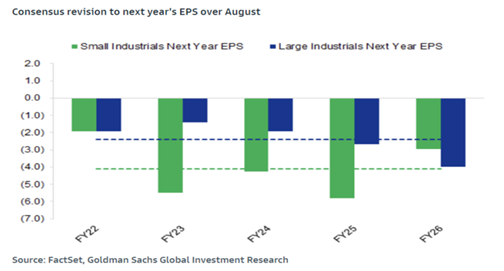

For the first time in four years, small caps outpaced large companies and saw fewer earnings downgrades for the year ahead (see chart below).

This suggests a turning point in investor confidence. A mix of tax cuts, lower interest rates and easing cost-of-living pressures has created a more supportive backdrop, boosting consumer spending and helping rate-sensitive sectors regain momentum.

Key themes

Stronger-than-expected results rewarded

Investors were quick to back companies that exceeded expectations. Smaller industrial businesses were standouts, with almost half reporting stronger-than-expected numbers. This highlights the importance of careful stock picking, as not all companies benefited equally.

Heightened volatility

Reporting season once again brought sharp share price moves, with record levels of intra-day swings (see chart below). For active investors, this created both risks and opportunities.

Signs of consumer resilience

Consumer discretionary stocks were among the best performers. After two weak years, household goods spending in Australia bounced back strongly, while New Zealand’s economy showed signs of recovery following earlier interest rate cuts. Consumer lending businesses also thrived in the lower rate environment.

Within our funds, we held retailers such as Nick Scali and ARB Corporation, alongside lenders including Judo, MA Financial and Plenti.

Mining, energy and infrastructure strength

Companies supporting mining, oil and gas, and renewable projects reported robust earnings, with growth underpinned by strong order books. We see this as a mid-cycle trend, offering a solid pipeline for the next year.

Our holdings included Monadelphous, MacMahons, Wagners and SRG Global.

Avoiding the weak spots

Our funds had little exposure to the underperforming US housing sector, avoiding major disappointments such as James Hardie, Reece and Reliance.

Looking ahead

Overall, we were encouraged by the results from the companies we invest in, as well as by how our funds performed. We see reporting periods as a point in time, a valuable milestone to test our investment thesis.

However, we invest taking a longer term view, focused on the business fundamentals that will cause either earnings to grow ahead of market expectations, or the quality of the business to be more accurately reflected through a re-rate.

Looking forward, we’re cautiously optimistic about the outlook for small and mid caps. With supportive government policy, lower interest rates and capital flowing back into the economy, conditions are in place for these companies to deliver attractive long term returns for investors.

Information is current as at 17 September 2025. Pie Funds Management Limited (“Pie Funds”) is the issuer and manager of the Pie Funds Management Scheme and the Pie KiwiSaver Scheme (“Schemes”), the product disclosure statements of which can be found at www.piefunds.co.nz.. For personalised financial advice, please speak to a financial adviser. The information is given in good faith and has been derived from sources believed to be reliable and accurate. However, neither Pie Funds nor any of its employees or directors gives any warranty of reliability or accuracy and shall not be liable for errors or omissions herein, or any loss or damage sustained by any person relying on such information, whatever the cause of loss or damage.