SMALL CAPs are on SALE

I’m certainly glad to have the month of October behind us. Geopolitical risks and higher interest rates sent the market into a tailspin.

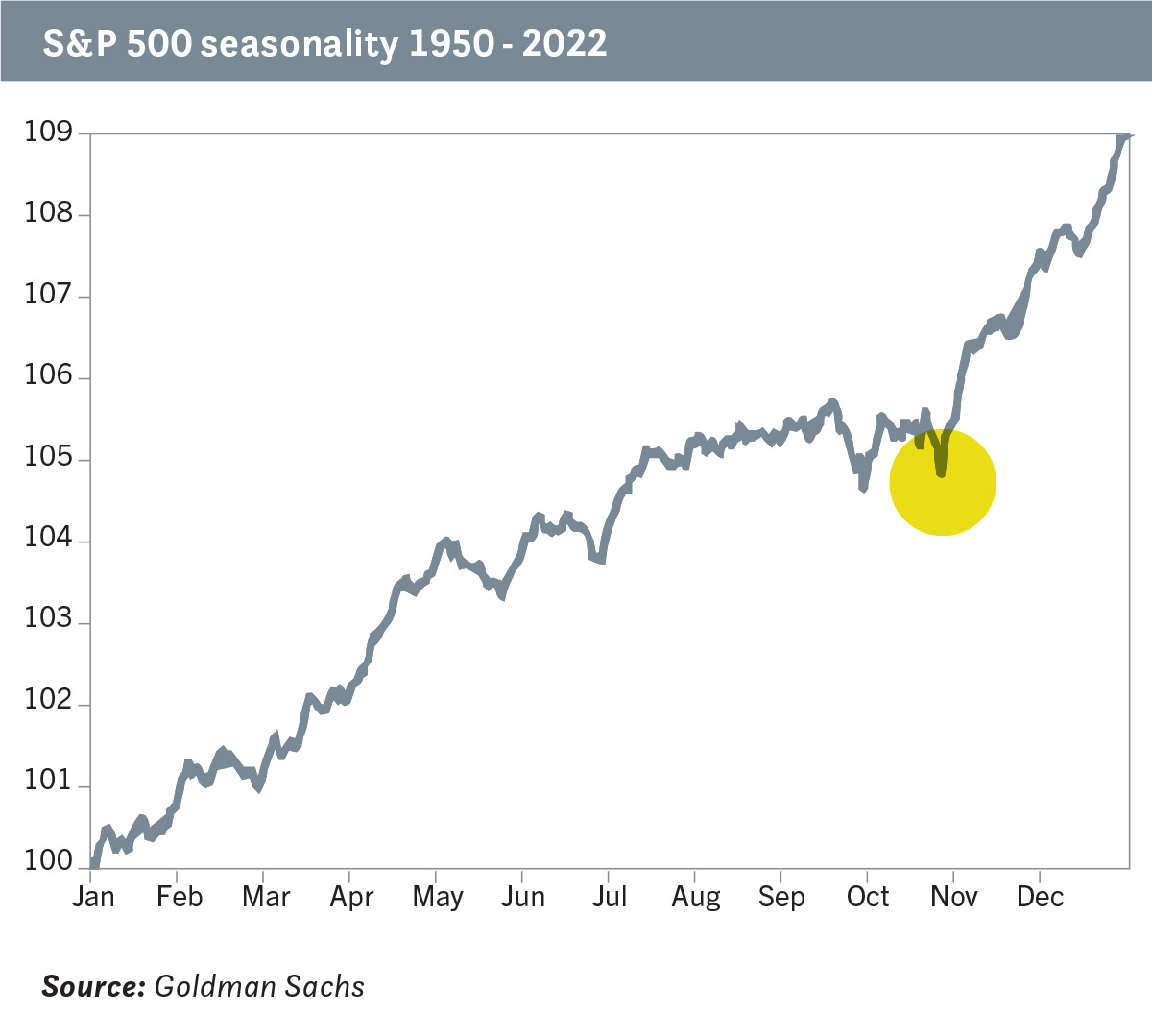

Fortunately, as November has commenced, seasonally we’ve moved into a period which has historically been a positive time for markets, and sure enough, right on cue, the winds have shifted.

If you have had the time to attend one of our investor series events over the last two weeks, you will recall that one of the key themes of my presentation was that markets can turn on a dog whistle. The two examples I showed of bear markets that were induced by a higher interest rate policy, 1980 and 2018, illustrated that rebounds can be very swift once it becomes clear that rates have peaked for the cycle and financial conditions are easing. Please email the team if you would like a copy of the presentation, and the videos will be available shortly with our mid-month Market Update. In both of these examples, the S&P 500 recovered all off its bear market fall in a 2-3 month period and in the 2018 case, the market bottomed a full 6 months before the first rate cut. At the start of November the US small cap index, the Russell 2000 rallied 7% in 3 days, which would eclipse any annual pre-tax return Term Deposits are currently offering. Cash is a great tool, but shifting to cash, 2-3 years into a bear market is not a good investment strategy. Is this the top in rates and a bottom for stocks? We won’t know that until after the fact, but it’s a healthy place to start the conversation.

With markets having rejected a 5% yield on the US 10 treasuries during October, and a similar scenario playing out around the world, there is certainly a strong argument to mount that rates have peaked. We believe that inflation will continue to moderate, the labour market will soften and higher interest rates will impact both consumers and small businesses. Fortunately, we do not think this will lead to a deep recession, but these conditions should give the FED and other Central Banks, the legitimacy to turn more dovish in 2024. This, combined with a bottoming of the inventory cycle, should turn the stock market headwind into a tailwind again. However, due to budget deficits and an oversupply of Government debt, without QE or a deep recession, we don’t foresee interest rates falling back anywhere near where they were in 2021. So yes, rates are now higher for longer, but perhaps not as high as they currently are.

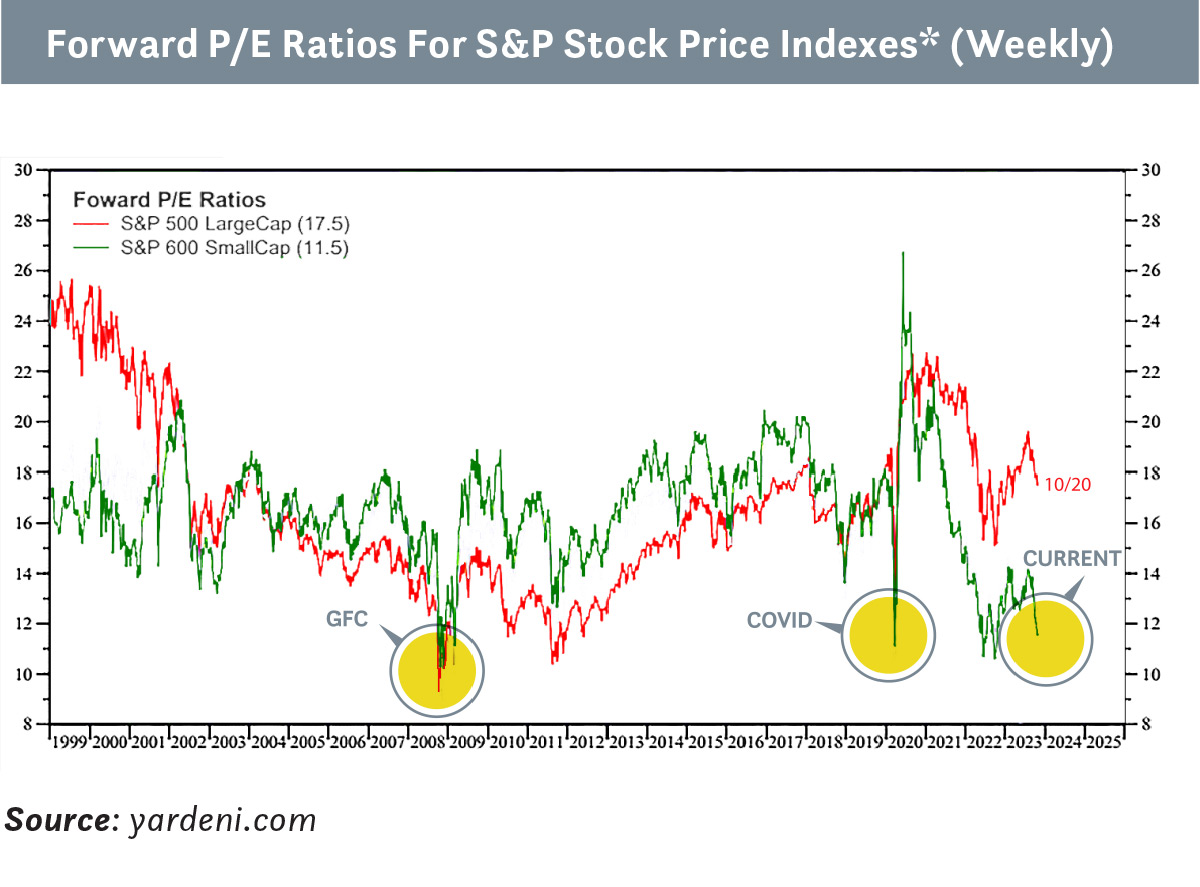

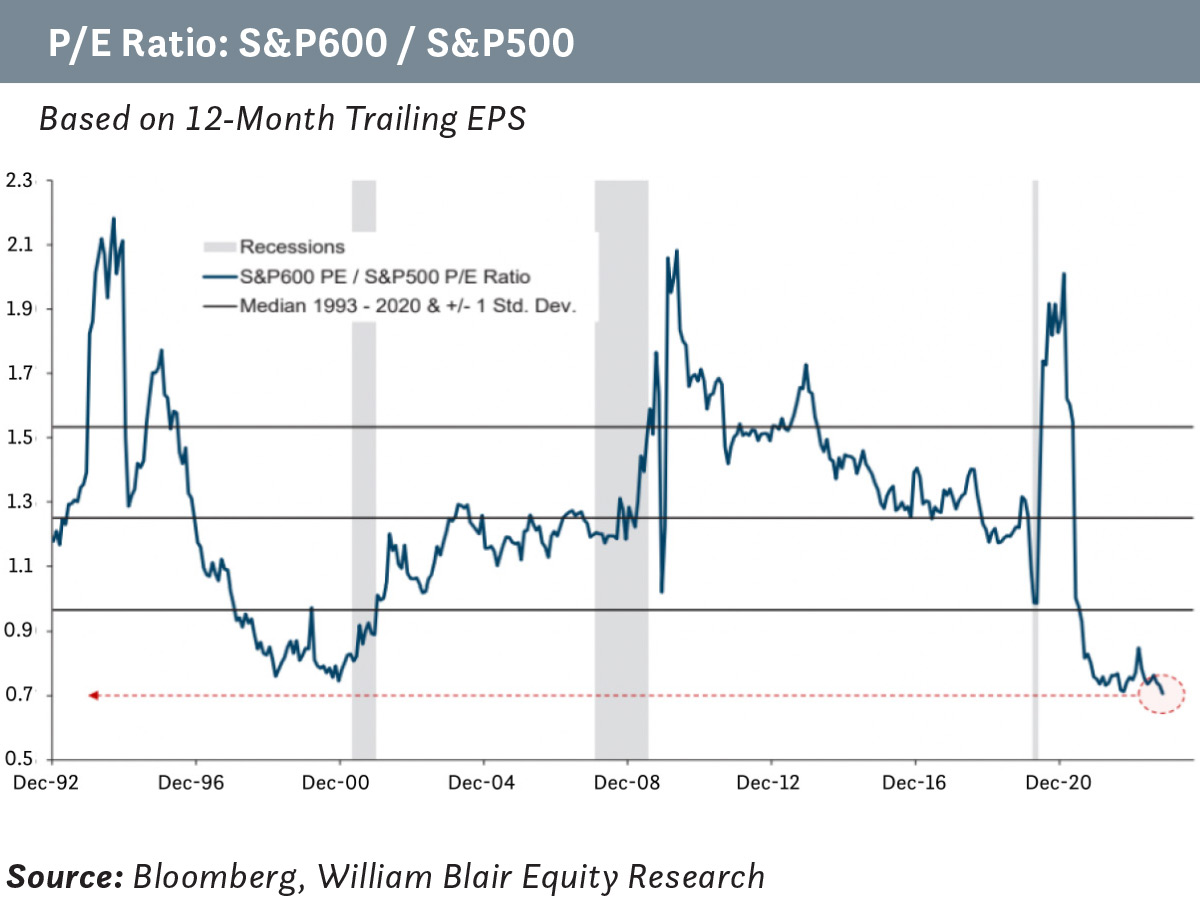

I also highlighted during my presentation the significant opportunity that exists in small caps, which are not only cheap in a relative sense vs large caps, but also cheap in an absolute sense. The market, particularly in Europe, has simply become too bearish, and globally small caps have been out of favour. The Wall Street Journal called small caps, “almost a buy”, because nobody wants to be first, let alone early. However, we believe there is a significant margin of safety at present for small cap investors and that today represents the best buying opportunity for small caps in 30 years, except for the depths of the GFC.

Small Caps are Cheap

And finally, the team thoroughly enjoyed catching up with so many of you around the country over the last two weeks. Thank you for your attendance and feedback. We are thrilled that the continued outstanding performance of Pie Australasian Dividend Growth Fund has again been recognised, named as a finalist for Research IP - Australasian Equities Fund of the Year, which we won two years ago. For those who couldn’t join us, I am excited to announce the launch of two new products in early December; the Pie Property & Infrastructure Fund and the Pie Fixed Income Fund. We talk a lot about diversification and with current conditions and feedback from investors, we believe the timing is right to make these asset classes available to our clients. This will open new options for investors to access these asset classes individually or as part of a wider diversified portfolio.

Thank you again for your support. If you have any questions, please don’t hesitate to email me on [email protected]

Mike Taylor

Founder and Chief

Investment Officer

You’re just 2 minutes away from starting your journey with the Pie KiwiSaver Scheme.

Invest now Invest now

Information is current as at 31 October 2023. Pie Funds Management Limited is the manager of the funds in the Pie Funds Management Scheme. Any advice is given by Pie Funds Management Limited and is general only. Our advice relates only to the specific financial products mentioned and does not account for personal circumstances or financial goals. Please see a financial adviser for tailored advice. You may have to pay product or other fees, like brokerage, if you act on any advice. As manager of the Pie Funds Management Scheme investment funds, we receive fees determined by your balance and we benefit financially if you invest in our products. We manage this conflict of interest via an internal compliance framework designed to help us meet our duties to you. For information about how we can help you, our duties and complaint process and how disputes can be resolved, or to see our product disclosure statement, please visit www.piefunds.co.nz. Please let us know if you would like a hard copy of this disclosure information. Past performance is not a guarantee of future returns. Returns can be negative as well as positive and returns over different periods may vary.